Digital Banking Guide

Digital Banking Login

If you are already a user of Osgood Bank's online banking, you don't need to enroll again. If you are a new customer and/or have never used Osgood Bank's online banking, start with our Enroll section.

This section is only for customers who have never used Osgood Bank online banking and are enrolling for the very first time. If you've used our online banking previously, there is no need to enroll again.

- To enroll in Digital Banking from your desktop, laptop or tablet, click here.

- You can also visit one of our branches, and we’ll help you enroll.

You only need to enroll on one device. After you enroll, you can log in to your account from any device.

Use the following steps to log in to Digital Banking.

-

Log in using your username and password.

-

Select how you'd like to receive a secure access code. You can choose text or call depending on the information we have on file for you. Notice incorrect information? Double check the username first. If your username is entered correctly, call your local branch for assistance.

-

Enter the access code you received.

- On your initial visit, you will be asked to review the disclaimer and approve it. Once accepted, you'll be taken to your Digital Banking homepage.

-

Review your profile information.

-

If using a mobile device, you will be asked to register your device.

Note: If you have set up your browser to clear your browser's cookies and cache, you will be required to receive a new secure access code each time you visit. (2-step verification)

Download the App!

Search for "Osgood Bank" in the respective store or use one of the links below (from your phone or tablet).

Logging in to the app works like logging in to the desktop.

-

Enter your username, click continue.

- Enter your password, click continue.

-

If you are prompted for a security code, you will receive at text with your unique access code.

-

Enter the access code you received.

-

Review your profile information (if logging in the first time).

-

Choose to register your device or not. (If you're on a shared device or shared network, we suggest not registering the device.)

-

Review the first time disclaimer (if logging in the first time), approve it and you'll be taken to your app homepage.

Fingerprint/Touch or Face ID

Depending on your device, you might see an option for "Face ID", "Touch ID", or "Fingerprint", on the mobile app login screen. Touch this link if you want to setup a biometric login option.

Money Movement Services

Take advantage of these services through your digital banking platform.

With Bill Pay you are able to pay your bills in just a few clicks, saving time and postage. In addition, you can set up recurring payments for monthly bills.

-

Gather your bills, including account numbers and the address where payments should be mailed.

-

For initial setup, log into your online banking account or mobile app.

-

On your desktop, click "Create Transaction" then "Bill Pay".

In the app, click "Bill Pay". -

Enter each biller's information, choose when to send your payment, and select recurring or one-time payment.

Pay bills individually or save time by paying multiple bills at once. We'll send the payments as you wish and confirm with an email so you know it's taken care of.

Card Control Features:

-

Turn your card on and off. This allows you to disable your card if it has been left behind, lost, or stolen. When your card is turned off, all transactions, with the exception of recurring payments, will be declined.

-

Location control. Block international transactions or assign up to three geographical regions where you card can be used.

-

Transaction types*. You can elect to allow only certain types of transactions such as in-store, online, ATM, and more.

-

Merchant categories*. Select the types of merchants your card can be used at such as retail stores, gas stations, grocery stores, restaurants, etc.

-

Spending limits. Set a dollar limit for transactions on your card. You can elect to receive alerts and/or automatically decline transactions that exceed your predetermined limit.

*Transaction types and merchant categories are not determined by Osgood Bank.

Use the following steps to log in to Digital Banking.

-

From your mobile app menu, select "More" and then "Cards"

-

Select your Osgood Bank debit card.

-

Use the various categories to manage your preferences.

Point. Click. Done.

-

Sign/Endorse your check.

-

Under your signature write "For Mobile Deposit Only to Osgood Bank" and the check number from the front of the check.

-

Open your Osgood Bank mobile app.

-

Tap the plus sign and select deposit.

Note: The next screen will provide you with a reminder of how to endorse your check, processing times, and deposit limits. Tap continue to move to the next step.

-

Take pictures of the front and back of your check, verify your information, and then click continue to approve your deposit.

You'll receive an immediate email confirming that we've received your deposit and another when we've accepted it for processing.

Keep the check for 30 days before destroying or disposing of it. Osgood Bank’s deposit team will contact you if there any issues with the mobile deposit, including if we need you to deposit it again or bring it into a branch.

Lighten Your Load When You Combine Your Wallet With Your Phone

Each vendor varies in how to set up your wallet, but each are painless to get started. First, you'll download the app to the respective type of phone you have. Next, just follow the in-app instructions to enroll your Osgood Bank debit card.

You'll be on your way to more convenient and secure transactions in no time.

Moving money between your accounts is easy with digital banking.

On a desktop, select "Create Transaction" in the navigation menu.

On the app, tap "Transfers" in the menu, then select "Make Transfer" at the top.

- Choose the account to transfer from and to.

- Input the amount of the transfer.

- You have the option to put a description to help you reference this transfer.

- Choose the transfer frequency (one time or recurring).

Click "Continue" to review your inputs and finalize your money movement.

Zelle® is a fast and easy way to send money to friends, family, and others you trust using your mobile banking app or online banking account.

Getting Started is Easy

-

Log into the Osgood Bank app.

-

Tap "More" at the bottom of the screen, then select Zelle®.

-

Enroll your U.S. mobile number or email address.

-

Send money to friends, family and others you know and trust.

Transactions typically occur in minutes when the recipient's email address or U.S. mobile number is already enrolled with Zelle®.

Users must have a bank account in the United States to use Zelle®.

In order to send payment requests or split payment requests to a U.S. mobile number, the mobile number must already be enrolled with Zelle®.

Have you received a request for money? To complete the request:

-

Log into the Osgood Bank app.

-

Tap "More" at the bottom of the screen, then select Zelle®.

-

Select "Send Money with Zelle".

-

Go to Activity to view your pending request.

- Select the request, verify the amount, and complete your transfer.

Zelle® and the Zelle® related marks are wholly owned by Early Warning Services, LLC and are used herein under license.

Settings

Set up your account the way you want it.

To update your username, password, and contact information:

From a desktop, select "Manage Settings" from the menu, then select "Manage Profile".

Tab between the options to set up your profile:

- Change Password

- Personal Preferences

- Change Username

- Mobile Banking Text Banking

From the app, select "More" with the three dots icon, then tap "Login & Security".

- Change username

- Change password

- Update Contact Info

Set up account alerts to notify you of activity on your account:

On a desktop, navigate to "Manage Settings" and select "Alerts".

On the mobile app, click "More", "Notifications and Alerts", and then "Alerts".

-

Select the account you wish to manage from the drop down list.

-

Review the different alert options.

-

Turn the alert on/off

-

Enter the amount you wish to be alerted to.

-

Select which notification method(s) you prefer.

-

Be sure to click "Update" when you have finished updating your preferences.

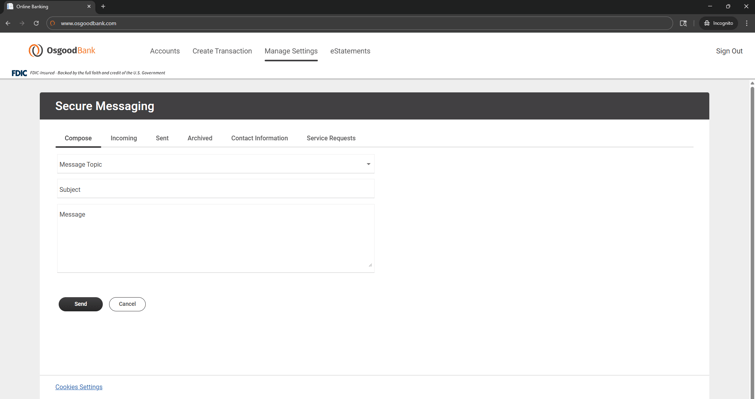

The ‘Secure Messaging’ feature is a secure messaging function which allows for two-way communication between the Digital Banking user and Osgood Bank. The message is delivered securely within the Digital Banking system and not via email.

-

On a desktop, navigate to "Manage Settings", then "Secure Messaging".

-

On the mobile app, click "More", "Notifications & Alerts", then "Secure Messaging".

For additional services such as address changes, debit card orders, and document requests, navigate to the "Service Request" tab in "Secure Messaging".

Digital Banking System Requirements

Digital Banking technology works with the latest technology options. Take a look at our list for minimum system requirements.

You should be able to use any modern browser to enjoy a full desktop banking experience with Osgood Bank Digital Banking.

Chrome, Firefox, Edge and Safari (Mac) are all recommended.

Although our online banking platform will function in a mobile browser, we urge you to utilize our mobile app instead. There are some digital features that are specific to the app, and your banking experience will be better using the app on your mobile device.

For desktop, we recommend, at minimum, Microsoft Windows 10 or Mac OS X 10.10. For best performance and security, we recommend newer operating systems.

For mobile, ensure that you are using Android 5.x and later or iOS 12.x and later for best performance and security.