What You Should Know

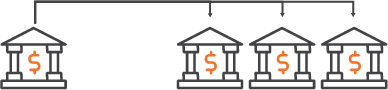

How ICS Works

Deposit

You deposit a large sum, over the FDIC-insured limit, into your ICS enabled account.

Divide

Osgood Bank divides the deposit into amounts under the FDIC-insured maximum

Distribute

Your funds are placed at multiple FDIC-insured banks in the IntraFi℠ network.

Deliver

Receive expanded FDIC protection while working directly with a bank you know and trust.

ICS vs Traditional Accounts

| Feature | ICS | Regular Checking/Savings |

|---|---|---|

|

Feature

FDIC Coverage

|

ICS

Multi-million dollar FDIC protection through network banks

|

Regular Checking/Savings

Up to $250,000 per depositor, per bank

|

|

Account Access

Account Access

|

Account Access

Single point of access through Osgood Bank

|

Account Access

Manage multiple banking relationships across multiple banks |

|

Statements

Statements

|

Statements

Consolidated reporting across all ICS placements

|

Statements

One statement per account; multiple statements to review |

|

Liquidity Options

Liquidity Options

|

Liquidity Options

Choose between demand or savings options depending on your needs

|

Liquidity Options

Standard withdrawal and transfer rules |

|

Interest Earnings

Interest Earnings

|

Interest Earnings

Competitive returns on large balances while fully insured

|

Interest Earnings

Varies by account type |

Quick Answers to Common Questions

The FDIC will insure up to $250,000 of an individual’s deposit accounts at an FDIC-insured financial institution.

You could manually open deposit accounts at different banks in order to obtain FDIC insurance on a total larger sum.

The benefit of enrolling in ICS is that we will do that for you, saving you time and hassle.

Yes, the Deposit Control Panel (DCP) is a secure website specifically created to help you manage your ICS account(s). Although we do the legwork for you, we want to ensure you maintain control.

Using the DCP, you can:

-

Check your balance. Review your balance at each Destination Institution, including principal and accrued interest.

-

View where your funds could be placed. View the list of institutions where your funds could be placed. This list does not include institutions you have previously excluded.

-

Review and manage daily proposed fund placements. You may review any placements on the Proposed Placement List. Depositor Placement Review (DPR) is available each business day from 3:00 to 3:15 pm EST.

-

Track monthly program withdrawals and view your transaction history. View the list of transactions for your account, including deposits, withdrawals, and capitalizations over the last 45 days. Balance and interest rate history for the past 45 days are also available.

As always, you can always contact us with any questions.

The DCP is available at https://www.depositorcontrol.com/login.

If you are creating a new DCP account, click "GET STARTED."

Next, enter the applicable information to verify your account including:

-

any transaction account number associated with your IntraFi Network Deposits account(s),

-

last four digits of your tax ID/SSN, and

-

email address associated with your account.

Please create a new username and password, then click "VERIFY AND CREATE MY ACCOUNT."

You will receive an email from no-reply@depositorcontrol.com to verify your account. If you do not receive the email, check your spam folder. Once you click the verification link in the email, it will take you back to the login screen to enter your username and password.