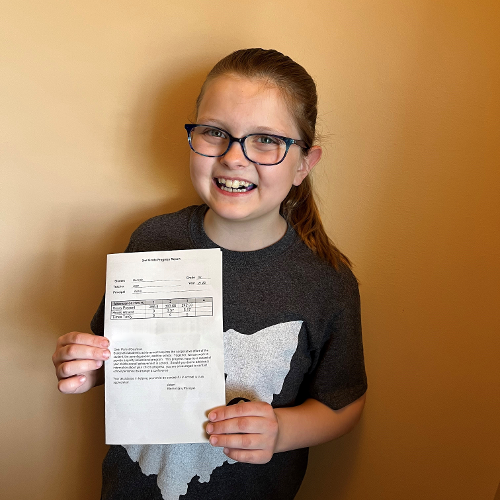

Students K-12 earn $2 for every final "A" and $1 for every final "B" on year-end report cards.

Thanks to our partnership, the whole family can learn real-world financial education for free.

Open a youth savings account for as little as $10 to help your little one build a nest egg for their future.

It's never too early to establish healthy financial habits. A youth savings account is a smart way to help teach your child money management, budgeting, and more.

Increasing financial education with experience can lead to increased opportunity for long-term financial success.

Youth savings account owners are eligible for a bonus when they present their year-end report card at an Osgood Bank branch in June or July immediately following the end of the school year.

We will review final grades and deposit $2 for each "A" and $1 for each "B" directly into the child's account.

Each child is eligible to receive up to $50 in bonus earnings per school year. See a representative for more details.

Check out our library of courses, articles, and financial calculators.

The Osgood Bank Learning Center is designed to provide the whole family with money management tips, tricks, and resources.

When the child turns 18, their youth savings account will automatically convert to a regular savings account. The child will remain the primary account holder and, at that point, the child or parent can submit a request to remove the parent from the account.

If your child's youth savings account earns enough interest, the income will be reported under the child's Social Security number. The chance of this happening for a savings account is small, but we will send you a tax form if it applies to you.

Children with a youth savings account are not eligible for online and mobile banking profiles. However, the parent/guardian on the account can link the youth account to their online banking profile for easy viewing and management.

Anyone can make deposits into this account as long as they have the account number (and routing number if they are transferring money into the account electronically).

Yes. You can open accounts for grandchildren, nieces, nephews, or any loved one as long as you have the appropriate identifying information for the child.

Careers

Osgood Foundation

Disclosures

Privacy Policy

Accessibility Statement

Routing Number: #042212568

If you use links provided on the Osgood Bank website that redirect to a third party website, you are acknowledging that you are leaving www.osgoodbank.com and are going to a website that is not operated by Osgood Bank. Osgood Bank is not responsible for the content or availability of linked sites. Osgood Bank does not represent either the third party or the visitor if a transaction is entered. In addition, privacy and security policies may differ from those at Osgood Bank.