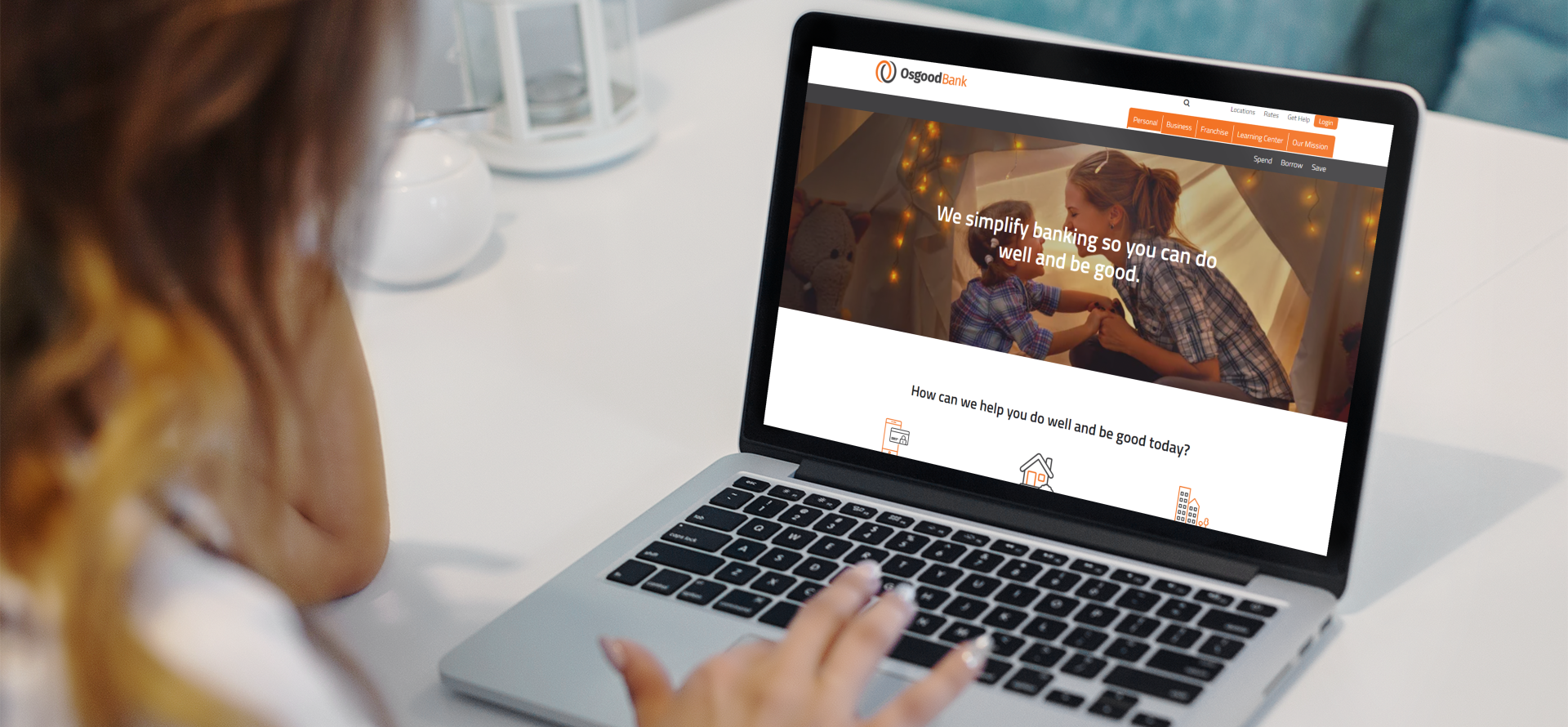

Bank Securely From Anywhere With Online & Mobile Banking

If you’ve been on the fence about doing your banking online or through a mobile app, now is a good time to get started. Financial services are available for you to handle your banking needs from the comfort of home or when you’re out and about. So, what can you do with online and the mobile banking app?

If you’ve been on the fence about doing your banking online or through a mobile app, now is a good time to get started. Financial services are available for you to handle your banking needs from the comfort of home or when you’re out and about. So, what can you do with online and the mobile banking app?

Online and mobile banking allows you to access your accounts through a personal computer, tablet, or phone with ease. You now can catch errors such as unauthorized activity earlier – without having to wait for your paper statement. If you need to transfer money between accounts, our online banking or mobile app offers you options to do that. Instead of writing checks and mailing them, you can pay most bills online or through the mobile app. You can set up automatic notifications to help you manage your account and alert you when any of the following happen: account transfers, your balance falls below a certain amount or exceeds a certain amount, stop payments, changes to your account, next payment due, and more. These alerts can help ensure you stay informed without having to log in to your account several times a day.

Osgood Bank has continued to enhance our digital services to give our customers features that give them control of your accounts through the mobile app, like Zelle, Card Controls and Mobile Deposit. These new features offer a variety of highlights that are Available 24 hours a day, 7 days a week.

Osgood Bank has continued to enhance our digital services to give our customers features that give them control of your accounts through the mobile app, like Zelle, Card Controls and Mobile Deposit. These new features offer a variety of highlights that are Available 24 hours a day, 7 days a week.

Zelle: Using your Osgood Bank App, you can use Zelle to send and request money with just an email address or mobile phone number. The funds are sent directly to the recipient’s account within minutes. Zelle works entirely through your financial institution and protects your sensitive account details when you send or receive money. When someone sends you money using your enrolled email address or mobile number, Zelle notifies your financial institution, which then directs the payment to your account. It’s one of the easiest, safest, and fastest ways to make person-to-person mobile payments!

Card Controls: Want to keep your debit cards safe and secure? Turning it on and off can do just that. You're in control of where and when your card gets used. If you're trying to stick to a budget, Card Control allows you to set spending limits by merchant types and other parameters that can change with your spending needs. Have more than one card? You also can add any card tied to the same account to your controls. So, if you’re an authorized signer on your minor’s account, Card Controls allow you to set restrictions and budgets as well.

Mobile Deposit: Conveniently deposit checks to your account anywhere, anytime from your mobile device. The check image does not remain on the mobile device and transmitted data is encrypted. Mobile Deposit is available to users with a camera-enabled iPhone, iPad or Android device. Funds will be available the next business day unless a hold is applied and can be submitted into either a checking or savings account.

So, if you’re ready to get started, remember banking online or through your mobile device is secure, as long as you follow best practices for keeping the information on your mobile device(s) safe which includes:

-

Never share your password or PIN number

-

If you receive a call from “support”, they should never ask for a one-time code for Zelle, your debit card PIN, or the 3 digits on the back of your card. Hang up and call Osgood Bank directly, 419-582-2681.

-

You may receive alerts via phone, text, or email from Falcon, our debit card fraud monitoring service, but please also follow up with the bank directly if you suspect fraud.

-

Use complex passwords and/or enable facial recognition or fingerprint authentication if your device and app allow it.